Guarantee Agreement – Civil Code Revision

- 1 Introduction

- 2 What is a guarantee contract?

- 2.1 Scope of guarantee obligation

- 2.2 Relationship between the principal obligation and the guarantor’s burden

- 2.3 Necessity of qualification to be guarantor

- 2.4 Effect of reasons that occurred to the principal obligor – Effect also occurs to the guarantor

- 2.5 Effect of event occurring with respect to guarantee obligation-Not affecting the principal obligation

- 2.6 Rights of indemnification of guarantor entrusted by the principal debtor Rights of indemnification after the fact

- 2.7 Rights of indemnification of guarantor not entrusted by the principal debtor Rights of indemnification after the fact

- 2.8 Obligation to notify and indemnification Guarantor’s obligation to notify

- 3 What is a joint and several guarantee contract?

- 3.1 Differences from ordinary guarantee contracts (1)-No defense of demand or retrieval

- 3.2 Differences from ordinary guarantee contracts (2)- The guarantee obligation that each guarantor assumes is the whole amount of the principal obligation

- 3.3 Effect of the reason that occurred about a joint and several guarantor – In principle, it does not extend to the principal debtor *Civil Code revision*

- 4 What is a revolving guarantee contract?

- 4.1 What is an individual revolving guarantee contract?

- 4.2 It is indispensable to stipulate the maximum amount in writing *Civil Code revision*

- 4.3 Effect of failure to stipulate the maximum amount in writing – Invalidity

- 4.4 Principal Fixation Date of Individual Revolving Guarantee Contracts

- 4.5 Principal fixing event of individual revolving guarantee contract (termination of guarantee due to special circumstances)

- 4.6 Individual Guarantee for Right of Reimbursement under Revolving Guarantee Contract where Guarantor is a Corporation

- 4.7 Summary of Key Points of Individual Revolving Guarantee Contracts

- 5 Guarantee contracts for business loans – Confirmation of intent to guarantee by a notary is required *Revised Civil Code*

- 6 Obligation to provide information to the guarantor *Civil Code revision*

Introduction

When an individual borrows a house, when borrowing money from someone, when a company does business with another company, when borrowing working capital for business, etc., both individuals and companies are required to have a guarantor from the other party in various situations, and may be requested to be a guarantor.

In the revised Civil Code(hereinafter referred to as “Revised Civil Code” or “Civil Code”), which was revised for the first time in about 120 years and has been in effect since April 1, 2020, various revisions have also been made to the provisions regarding guarantees. The provisions of the Civil Code before the amendment are applied to the guarantee contract concluded before April 1, 2020, but the provisions of the amended Civil Code are applied to the guarantee contract concluded on and after April 1, 2020.

In the following, I would like to explain the thing concerning the guarantee widely from the basic thing of the guarantee that what is a guarantee contract in the first place to the content of the Civil Code revision.

What is a guarantee contract?

The guarantee contract is a contract of guarantee that promises to assume the obligation (this is called “guarantee obligation”) to perform the performance to the creditor in place of the main debtor when the main debtor does not perform the obligation to the creditor. The contract of guarantee refers to the contract between the guarantor and the creditor who promises to assume the obligation (this is called “guarantee obligation”) to the creditor in place of the principal debtor when the principal debtor does not perform the obligation to the creditor.

The guarantee contract does not become effective unless it is made in writing (Civil Code Article 446, paragraph 2). However, when the guarantee contract is made by the electromagnetic record that recorded the content, it is regarded as having been made by the document (Civil Code Article 446, paragraph 3).

Scope of guarantee obligation

Guarantee obligations include interest on the principal obligation, compensation for penalties and damages, and all other obligations subordinate to the principal obligation (Civil Code Article 447, Paragraph 1). Therefore, the guarantor who guaranteed the principal debtor’s loan obligation to the creditor has guaranteed not only the principal, but also interest and damages for delay.

Relationship between the principal obligation and the guarantor’s burden

Since the guarantee obligation is intended to secure the performance of the principal obligation, it is not allowed that the guarantor’s burden is heavier than the principal obligation in the purpose or manner of the obligation, and when it is heavier than the principal obligation, it is said to be reduced to the limit of the principal obligation (Civil Code Article 448, paragraph1).

For example, if the principal debt is due on January 31, 2030, and the guarantee contract stipulates that the performance date of the guarantee obligation is June 30, 2029, the performance date of the guarantee obligation will be January 31, 2030. If the creditor exempts 2 million yen out of the 5 million yen loan obligation, the guarantee obligation will also be reduced by 2 million yen.

On the other hand, the burden of the guarantor is not aggravated when the purpose or the manner of the principal obligation is aggravated after the conclusion of the guarantee contract because it is not reasonable that the burden of the guarantor is aggravated without the guarantor’s knowledge even though the purpose is to secure the performance of the principal obligation (Civil Code Article 448, paragraph 2, as clearly stated in the revised Civil Code).

Necessity of qualification to be guarantor

There is no limitation in principle about the qualification to be a guarantor. However, when the principal debtor is legally or contractually obligated to have a guarantor, the guarantor must be (i) a person who has the capacity to act and (ii) a person who has the resources to repay (Civil Code Article 450, paragraph 1). However, even in this case, when the creditor appoints a specific person as a guarantor, the requirements of (i) and (ii) are not applied to such guarantor (Civil Code Article 450, paragraph 3).

If the principal debtor is not able to set up a guarantor who satisfies the requirements of (i) and (ii), the principal debtor may provide other security in lieu of the guarantor (Civil Code Article 451).

Effect of reasons that occurred to the principal obligor – Effect also occurs to the guarantor

The postponement and renewal of the completion of prescription due to a claim for performance or other reasons against the principal obligor shall also be effective against the guarantor (Civil Code Article 457, Paragraph 1).

If you are interested in the postponement and renewal of the completion of prescription, please refer to our column ” Interruption and Suspension of Statute of Limitations under the Revised Civil Code”.

The guarantor may oppose the creditor with a defense that the principal debtor may assert (Civil Code Article 457, Paragraph 2, as clearly stipulated in the amended Civil Code).

In addition, when the principal obligor has a right of setoff, a right of rescission, or a right of release against the creditor, the guarantor may refuse to perform the obligation to the creditor to the extent that the principal obligor should be discharged from the obligation by exercising these rights (Article 457, paragraph 3 of the Civil Code, as clearly stipulated in the revised Civil Code).

Effect of event occurring with respect to guarantee obligation-Not affecting the principal obligation

The reasons that arose in the guarantee obligation do not affect the principal obligation. For example, even if the postponement or renewal of the completion of the statute of limitations is approved for the guarantee obligation, this will not cause the postponement or renewal of the completion of the statute of limitations for the extinction of the principal obligation.

Rights of indemnification of guarantor entrusted by the principal debtor Rights of indemnification after the fact

If a guarantor who has guaranteed the principal debtor on behalf of the principal debtor performs an act to extinguish the debt with payment and other his/her own property (hereinafter referred to as “act of extinguishment of debt”), the guarantor may demand compensation from the principal debtor for the amount of property he/she has spent for that purpose (Civil Code Article 459, Paragraph 1). However, if the amount of the property spent exceeds the amount of the extinguished principal debt, the amount of the extinguished principal debt is the upper limit.

However, if a guarantor who has guaranteed the principal debtor on behalf of the principal debtor commits an act of extinguishment of the debt before the principal debt is due, the guarantor may claim compensation from the principal debtor to the extent that the principal debtor benefited at that time (Civil Code Article 459-2, Paragraph 1). The compensation can be made only after the principal debt is due and payable (Civil Code Article 459-2, Paragraph 3, as clearly stipulated in the revised Civil Code).

Rights of indemnification in advance

A guarantor who has guaranteed the principal debtor on behalf of the principal debtor may exercise the right of recourse against the principal debtor in advance in the following cases (Civil Code Article 460).

(i) When the principal debtor has received a decision of commencement of bankruptcy proceedings and the creditors do not participate in the distribution of the bankruptcy estate.

(ii) When the debt is due and payable (however, a deadline forgiven by the creditor to the principal debtor after the guarantee contract cannot be asserted against the guarantor)

(iii) When the guarantor has received a judicial decree to the effect that he/she should make payment to the creditor without negligence (clearly stipulated in the revised Civil Code)

However, the principal debtor will suffer damage if the guarantor does not pay to the creditor afterwards when the principal debtor accepts the guarantor’s prior claim for indemnity.

Therefore, the principal debtor who accepts the guarantor’s advance demand for indemnity may demand that the guarantor provide security or that the guarantor indemnify him or herself while the creditor does not receive full repayment (Civil Code Article 461, Paragraph 1). In addition, the principal debtor may be discharged from the obligation to respond to the advance demand by depositing the amount demanded in advance, providing security, or having the guarantor indemnify him or her (Civil Code Article 461, Paragraph 2).

Rights of indemnification of guarantor not entrusted by the principal debtor Rights of indemnification after the fact

When a guarantor who guaranteed without being entrusted by the principal debtor performs an act of extinguishment of obligation, the guarantor can claim compensation from the principal debtor to the extent that the principal debtor benefited at that time (Civil Code Article 462, Paragraph 1, Civil Code Article 459-2, Paragraph 1).

When the guarantor guarantees against the intention of the principal debtor, the scope of the guarantor’s compensation is limited to the extent that the principal debtor is currently benefited (Civil Code Article 462, paragraph 2).

Regardless of whether or not the guarantor guaranteed against the intention of the principal debtor, if the guarantor who guaranteed without the commission of the principal debtor commits an act of extinguishment of the obligation before the principal debtor’s due date, the right of indemnity may be exercised only after the principal debtor’s due date (Article 462, paragraph 3 and Article 459-2, paragraph 3 of the Civil Code, as clearly stipulated in the revised Civil Code).

Rights of indemnification in advance

The right to seek indemnification in advance is not granted to a guarantor who has guaranteed without being entrusted by the principal debtor.

Obligation to notify and indemnification Guarantor’s obligation to notify

When the guarantor who guaranteed by receiving the consignment of the principal debtor does the act of extinguishing the obligation, it is necessary to notify the principal debtor in advance (The prior notice system of the guarantor who did not receive the consignment of the principal debtor was abolished in the revised Civil Code.)

When the act of extinguishment of obligation is performed without giving prior notice to the principal obligor, the principal obligor is able to assert against the guarantor on the grounds that he/she was able to assert against the creditor (the first sentence of Civil Code Article 463, Paragraph 1).

It is necessary to notify the principal debtor after the fact when the guarantor has committed an act of extinguishment of obligation regardless of whether or not it is entrusted by the principal debtor (Civil Code Article 463, Paragraph 3).

Principal Debtor’s obligation to notify

When the principal debtor has committed an act of extinguishment of obligation in cases where the guarantor has guaranteed the principal debtor on behalf of the principal debtor, the principal debtor is required to notify the guarantor of the extinguishment after the fact.

When the guarantor commits the act of extinguishment of obligation in good faith because he/she neglected to notify the guarantor, the guarantor is able to deem the act of extinguishment of obligation to have been valid (Civil Code Article 463, Paragraph 2), and such guarantor is able to make a claim against the principal debtor.

What is a joint and several guarantee contract?

The joint and several guarantee contract means the guarantee contract that the guarantor promises to assume the debt jointly and severally with the principal debtor (Civil Code Article 454). In addition, it always becomes a joint and several guarantee contract when the principal debt was caused by the commercial act of the principal debtor or when the guarantee is a commercial act (Commercial Code Article 511, Paragraph 2).

Differences from ordinary guarantee contracts (1)-No defense of demand or retrieval

In the usual guarantee contract, the guarantor is considered to be necessary to perform only when the principal debtor cannot perform, and the following is admitted to the guarantor.

(i) Defense of demand (Civil Code Article 452)

The guarantor can demand that the principal debtor should be given a notice first when the performance is demanded by the creditor.

(ii) Defense of search (Civil Code Article 453)

Even after the creditor has given notice to the principal debtor, the guarantor may refuse the creditor’s demand by proving that the principal debtor has the ability to repay and that execution is easy.

And if, despite the exercise by the guarantor of (i) the defense of demand or (ii) the defense of search, the creditor failed to obtain full repayment from the principal debtor because the creditor failed to demand or execute against the principal debtor, the guarantor is discharged from the guarantee obligation to the extent that the creditor could have obtained repayment by immediately demanding or executing the obligation.

On the other hand, in the case of a joint and several guarantee contract, the joint and several guarantors do not have the right of (i) defense of demand or (ii) defense of search (Civil Code Article 454). Therefore, the creditor can claim the performance of the guarantee obligation to the joint guarantor before the principal debtor.

Differences from ordinary guarantee contracts (2)- The guarantee obligation that each guarantor assumes is the whole amount of the principal obligation

In the usual guarantee contract, when there are two or more guarantors, each guarantor bears the guarantee obligation within the range of the amount divided in equal proportions (Civil Code Article 456, Article 427). For example, when two guarantors conclude a usual guarantee contract about the main debt of 6 million yen, each guarantor will bear 3 million yen, and the creditor can claim only 3 million yen each to each guarantor.

On the other hand, in the case of a joint and several guarantee contract, each guarantor bears the guarantee obligation for the entire amount of the principal obligation (Civil Code Article 454), and the creditor can claim the performance of the entire amount of the principal obligation from one of the several guarantors.

Effect of the reason that occurred about a joint and several guarantor – In principle, it does not extend to the principal debtor *Civil Code revision*

Under the Civil Code before the amendment, when an obligee made a claim for performance against a joint guarantor, the effect of the claim was considered to extend to the principal obligor, for example, it was interpreted that the effect of the deferment of the completion of prescription extended to the principal obligor.

However, there was a point of view that the principal debtor who did not naturally know that there was a claim of performance to the joint guarantor might suffer unexpected damage.

Therefore, in the revised Civil Code, the claim of the performance to the joint guarantor was not considered to be effective against the principal debtor in principle (Civil Code Article 458, Article 441). However, when the creditor and the principal debtor expressed their intention otherwise, it is said that they will follow such intention.

Therefore, if the creditor wants to make the effect of the deferment of the completion of prescription extend to the principal debtor when a claim for performance is made to a joint and several guarantor as it did under the Civil Code before the amendment, the creditor may stipulate in the contract with the principal debtor that “a claim for performance against a joint and several guarantor shall also be effective against the principal debtor”.

As mentioned above, as a general rule, the effect of the event that occurred with respect to the joint guarantor does not extend to the principal debtor. However, when there is a renewal between the joint guarantor and the creditor (Civil Code Articles 458 and 438), when the joint guarantor has a claim against the creditor and has used setoff (Civil Code Article 458, Article 439, Paragraph 1), the claim is extinguished for the benefit of the principal debtor, and when there is confusion between the joint guarantor and the creditor (Civil Code Article 458, Article 440), the joint debtor is deemed to have paid.

What is a revolving guarantee contract?

A revolving guarantee contract is a contract that guarantees an unspecified obligation that belongs to a certain scope as a principal obligation (Civil Code Article 465-2).

Typical examples of revolving guarantee contracts are as follows.

(i) When the president of the counterparty company guarantees all the debts that the counterparty company owes to the company collectively to the company when the company and the counterparty company conduct continuous transactions (credit guarantee)

(ii) When a company and an employee enter into an employment contract, and the employee’s parents guarantee the employee’s obligations under the employment contract (personal reference).

(iii) When a tenant’s parents collectively guarantee the tenant’s rent, etc. with the landlord when the tenant rents an apartment (rental guarantee)

A revolving guarantee contract can be either a limited revolving guarantee contract with restrictions on the maximum amount (hereinafter referred to as “maximum amount”) and guarantee period, or a comprehensive revolving guarantee contract with no restrictions on the maximum amount or guarantee period.

In a revolving guarantee contract, the amount of the principal debt is unknown because an unspecified debt is assumed to be the principal debt, and there is a risk that the guarantor will incur an unexpected debt in the future. Therefore, it was thought that it was necessary to protect the guarantor, and the provision that intended the protection of the guarantor was established to some extent even in the stage of the Civil Code before the revision. In the revised Civil Code, the provision is revised to extend and strengthen the protection of the guarantor more, and a new provision is established.

What is an individual revolving guarantee contract?

An individual revolving guarantee contract is a contract that guarantees an unspecified debt that belongs to a certain scope as a principal debt, of which the guarantor is not a juridical person (Civil Code Article 465-2, Paragraph 1).

Among individual revolving guarantee contracts, the one that the scope of the principal obligation includes debts such as loans (debts borne by receiving money lent or bills discounted) is called an individual revolving guarantee contract for loans (Civil Code Article 465-3, Paragraph 1).

The guarantor of an individual revolving guarantee contract is liable for the performance of the principal of the principal obligation, interest on the principal obligation, penalties, damages, and all other obligations subordinate to the obligation, as well as the amount of penalties or damages agreed upon for the guaranteed obligation, up to the maximum amount pertaining to the entire amount (Civil Code Article 465-2, paragraph 1).

It is indispensable to stipulate the maximum amount in writing *Civil Code revision*

However, even for individual revolving guarantee contracts other than individual revolving guarantee contracts for money lending, etc., there are cases where the guarantor is required to perform an unexpectedly large amount of guarantee obligation (for example, when a revolving guarantee contract was concluded with the lessee’s obligation of real estate as the principal obligation, and the lessee was in arrears of rent for a considerable period of time, and the guarantor was required to pay a large amount of equivalent to the rent) and this was a problem.

Therefore, in the revised Civil Code, the maximum amount must be set in writing for all individual revolving guarantee contracts (Civil Code Article 465-2, Paragraph 2, Paragraph 3). If the contract is made by electromagnetic record, it is deemed to be made in writing.

Effect of failure to stipulate the maximum amount in writing – Invalidity

If the maximum amount is not specified in writing, the individual revolving guarantee contract becomes invalid.

It is necessary to specify the maximum amount clearly so that the specific amount can be understood, such as “●●yen”. Please be careful to specify the maximum amount in writing when you conclude an individual revolving credit guarantee contract, because it will be considered invalid unless the maximum amount is specified in writing by the revised Civil Code, even for individual revolving credit guarantee contracts other than individual revolving credit guarantee contracts, in which the maximum amount did not need to be specified in writing by the Civil Code before the revision.

Principal Fixation Date of Individual Revolving Guarantee Contracts

When the principal of the principal of the principal obligation is fixed in an individual revolving guarantee contract, the date within five years from the date of conclusion of the contract must be specified in writing as the fixed date. If a date that exceeds five years from the date of conclusion of the contract is specified as the fixed date, it becomes invalid (Civil Code Article 465-3, Paragraph 1).

Where no fixed date for the principal of the principal of the principal obligation is stipulated in a revolving guarantee contract for individual loans, etc. (including cases where a date that exceeds five years from the date of conclusion of the contract is stipulated as the fixed date and the stipulation of the fixed date for the principal becomes invalid) The date on which the principal becomes fixed shall be the date on which three years have elapsed from the date of conclusion of the contract (Civil Code Article 465-3, Paragraph 2).

In the case of modification of the date of determination of the principal in a revolving guarantee contract for personal loans, etc., the modification of the date of determination of the principal shall be invalid if the date of determination of the principal after the modification is more than five years after the date of the modification. However, if the principal confirmation date is changed within two months prior to the principal confirmation date, and the date of principal confirmation after the change is within five years from the date of principal confirmation before the change, the change is not invalid (Civil Code Article 465-3, Paragraph 3).

There is no such limitation on the date of determination of principal for individual revolving guarantee contracts other than individual revolving guarantee contracts for loans, etc. as described above.

Principal fixing event of individual revolving guarantee contract (termination of guarantee due to special circumstances)

In the Civil Code before the revision, it was said that the principal was fixed when there were special circumstances such as the death of the principal debtor or the bankruptcy or death of the guarantor among the individual revolving guarantee contracts, only for individual revolving guarantee contracts for money loan, etc., and the principal debt occurring after that was excluded from the guarantor’s guarantee.

However, it was thought that there was a necessity to fix the principal and to protect the guarantor depending on the circumstances even in the individual revolving guarantee contract other than the individual loan etc. revolving guarantee contract.

Therefore, in the revised Civil Code, it is provided as follows (Civil Code Article 465-4).

(i) In the following cases, all individual revolving guarantee contracts are considered that the principal is fixed and the principal obligation that arises thereafter is not subject to the guarantor’s guarantee.

(a) When an obligee files a petition for compulsory execution or exercise of a security interest in the guarantor’s property with respect to a claim for the payment of money, and an order of commencement of those procedures is made.

(b)When the guarantor has received a decision of commencement of bankruptcy proceedings

(c)When the principal obligor or guarantor has died

(ii) In the case of a revolving guarantee contract for individual loans, etc., in addition to the above (i), the principal is fixed at the following times, and the principal obligation arising thereafter is excluded from the guarantor’s guarantee

(a) When an obligee has filed a petition for compulsory execution or exercise of a security interest for a claim for payment of money against the property of the principal obligor and an order of commencement of such procedure has been issued

(b) When the principal obligor has received a decision of commencement of bankruptcy proceedings.

Individual Guarantee for Right of Reimbursement under Revolving Guarantee Contract where Guarantor is a Corporation

Under the Civil Code before the amendment, a guarantee contract with an individual whose principal obligation is an obligation pertaining to the guarantor’s right of indemnity against the principal obligor was considered invalid only if the guarantor is a juridical person and the scope of the principal obligation includes a loan or other obligation, and if the maximum amount is not stipulated.

Under the revised Civil Code, with regard to a revolving guarantee contract in which the guarantor is a juridical person, regardless of whether the scope of the principal obligation includes debts such as loans, etc., if the maximum amount is not specified, the guarantee contract with an individual whose principal obligation is an obligation pertaining to the guarantor’s right of recourse against the principal obligor is void (Civil Code Article 465 (Civil Code Article 465-5, Paragraph 1).

Summary of Key Points of Individual Revolving Guarantee Contracts

| Personal Loan Guarantee Agreement | All individual revolving guarantee contracts(other than individual revolving guarantee contracts for personal loans, etc.) |

|---|---|

| Necessity to stipulate the maximum amount in writing | Necessity to stipulate the maximum amount in writing *The revised Civil Code expands the scope of stipulating the maximum amount in writing to all individual revolving guarantee contracts. |

| The principal is fixed for a period of 3 years if not stipulated, up to 5 years if stipulated | No limitation on the date of fixing the principal |

| Principal is fixed in the event of bankruptcy, death, or other special circumstances of either the primary obligor or guarantor Principal is fixed in the event of death of the primary obligor or guarantor, bankruptcy of the guarantor, or other special circumstances (excluding bankruptcy of the primary obligor) | Principal is fixed in the event of bankruptcy, death, or other special circumstances of either the primary obligor or guarantor Principal is fixed in the event of death of the primary obligor or guarantor, bankruptcy of the guarantor, or other special circumstances (excluding bankruptcy of the primary obligor) *The revised Civil Code expands the application of some of the grounds for the determination of principal, which had been provided only for individual revolving guarantee contracts for loans, etc., to all individual revolving guarantee contracts. |

Guarantee contracts for business loans – Confirmation of intent to guarantee by a notary is required *Revised Civil Code*

When a company or sole proprietor receives a loan for business, a third party such as a relative or friend who is not involved in the business became a guarantor without accurately understanding the contents due to personal feelings, etc., and later assumed an unexpectedly large debt and was driven to bankruptcy.

Therefore, under the revised Civil Code, when an individual concludes a guarantee contract in which the principal obligation is a loan or other obligation incurred for the business, or a revolving guarantee contract in which the scope of the principal obligation includes a loan or other obligation incurred for the business, in other words, when an individual intends to become a guarantor of a business loan, the said individual shall Before concluding a guarantee contract, a notary public must confirm the individual’s intention to guarantee (Civil Code Article 465-6, Paragraph 1).

When an individual intends to become a guarantor of a business loan, if the guarantee contract is concluded without going through the procedure of confirmation of intent to guarantee by a notary public, the guarantee contract will be invalid.

Cases in which confirmation of intent to guarantee by a notary is not required

In the following cases, confirmation of the intention to guarantee by a notary is not required.

(i) In cases where the principal debtor is a corporation, its director, executive director, executive officer, or a person equivalent thereto, or a person holding a majority of the voting rights of all shareholders of the principal debtor, etc.

(ii) In the case where the primary obligor is an individual, a partner of the primary obligor or a spouse of the primary obligor who is currently engaged in the business conducted by the primary obligor.

In the case of these persons, the relationship with the business of the principal debtor is deep, and the risk of concluding a guarantee contract without fully recognizing the risk of the guarantee is considered to be typologically low.

Procedure for confirmation of intention to guarantee by notary

The procedure for confirmation of the intention to guarantee by a notary is performed by the individual who intends to become a guarantor of the business loan by going to the notary public office and making a notarized declaration of intention to guarantee. This notarized declaration of intent to guarantee must be made within one month prior to the date of the conclusion of the guarantee contract.

The notarial deed of declaration of intention to guarantee is a notarial deed in which the person who intends to become a guarantor notarizes (i) the creditor and the debtor of the principal obligation, (ii) concrete contents of the principal obligation such as the amount and the range of the principal obligation, (iii) what is the content of the guarantee obligation that must be performed when the principal obligor does not perform the obligation, and has the intention to guarantee on the understanding thereof. The notary writes the content, and the person who intends to become the guarantor confirms the content of the description, and the signature and seal are made in the following flow. This procedure cannot be requested to the agent, and the guarantor himself/herself must surely receive the confirmation of the intention to guarantee in the face of the notary public.

The fee of the notary public for the procedure of notarization of declaration of intention to guarantee is 11,000 yen per one.

Obligation to provide information to the guarantor *Civil Code revision*

Obligation to provide information by principal obligor

In becoming a guarantor, it was a problem that an individual did not fully understand the property situation, etc. of the principal debtor and concluded a guarantee contract without a firm understanding of the risks of the guarantee.

Therefore, in the revised Civil Code, when entrusting a guarantee of business debt to an individual, the principal obligor must provide the individual with information on the following matters at the time of conclusion of the contract (Civil Code Article 465-10, Paragraph 1).

(i) The status of the principal obligor’s assets and income and expenditure

(ii) Existence or nonexistence of debts other than the principal debt, the amount thereof and the state of performance thereof

(iii) If the principal debtor has provided or intends to provide any other security for the principal obligation, a statement to that effect and the details thereof.

This obligation to provide information by the principal debtor is applicable only when the guarantor is an individual. It is not applied when the person who becomes a guarantor is a juridical person (Civil Code Article 465-10, Paragraph 3).

If the principal debtor did not provide the above information or provided information that is different from the fact and the entrusted person misidentified the matter and the guarantee contract was concluded thereby, and if the creditor knew or could have known that the principal debtor did not provide information or provided information that is different from the fact with regard to the matter, the guarantor can cancel the guarantee contract (Article 465-10, paragraph 2 of the Civil Code).

It is considered necessary for the creditor to take measures such as confirming in writing whether the above information was provided by the principal debtor to the guarantor at the time of the conclusion of the guarantee contract so that the guarantee contract will not be rescinded later.

Obligation to provide information by creditor At the time of claim from guarantor

Although the performance situation of the principal debtor is a serious concern for the guarantor, there was no legal provision that stipulates that the information can be obtained, and it had occurred that the creditor also wondered whether the information could be provided from the viewpoint of the privacy protection of the principal debtor.

Therefore, under the amended Civil Code, when there is a request from a guarantor who has guaranteed on behalf of the principal debtor, the creditor must provide the guarantor with the following information regarding the principal, interest, penalty, etc. of the principal obligation without delay (Civil Code Article 458-2).

(i) Existence or non-existence of default

(ii) Amount remaining

(iii) The amount of the remaining balance that has become due and payable.

This obligation to provide information by the creditor is applied even if the person who becomes a guarantor is an individual or a corporation.

When the principal debtor loses the benefit of time

If the principal debtor delays performance and the guarantor knows the loss of the benefit of time, the guarantor can take measures such as preventing the accrual of late payment by making replacement payment at an early stage, but the guarantor cannot know the delay in performance of the principal debtor naturally, and therefore, the guarantor will be liable for excessive burden due to the accrual of late payment without knowing. Therefore, it was a problem such as the thing that an excessive burden was borne by the occurrence of the delay damage etc. while not knowing it.

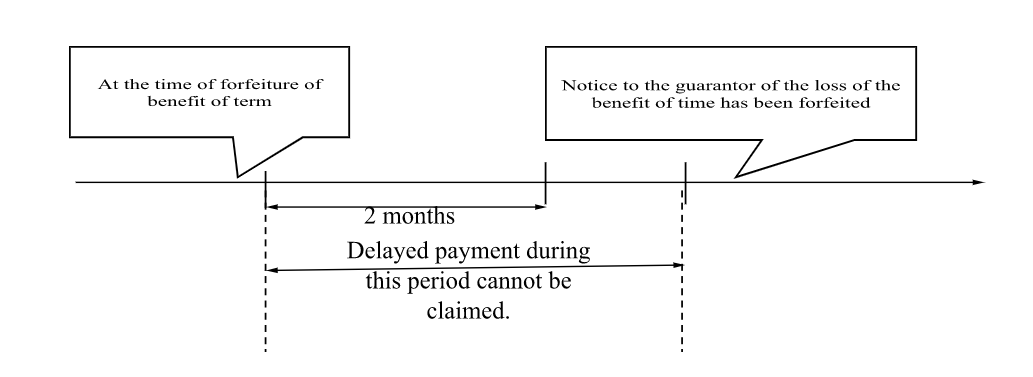

Therefore, in the revised Civil Code, when the principal debtor has the benefit of time, if the benefit of time is lost, the creditor must notify the guarantor to that effect within two months from the time when he/she knows the loss of the benefit (Civil Code Article 458-3, Paragraph 1).

This obligation to provide information by the creditor is applicable only when the person who becomes a guarantor is an individual. It is not applied when the person who becomes a guarantor is a juridical person (Civil Code Article 458-3, Paragraph 2).

If the above notice is not given, the creditor shall demand that the guarantor perform the guarantee obligation pertaining to the amount of the delay damages (excluding those that would have arisen even if the principal debtor had not forfeited the benefit of time) incurred from the time when the principal debtor forfeited the benefit of time until the actual giving of the notice. The creditor may not demand the guarantor to perform the guarantee obligation pertaining to the delayed damages (excluding those that would have arisen even if the benefit of time had not been forfeited) incurred from the time the principal obligor forfeited the benefit of time until the time the notice was actually given (Civil Code Article 458-3).

Summary of Points on Obligation to Provide Information to Guarantor

| Obligation to provide information of principal obligor | Obligation to provide information of creditor | |

|---|---|---|

| At the time of conclusion of contract | (i) Status of the principal obligor’s property and income and expenditure (ii) Existence or nonexistence of debts other than the principal debt and the amount thereof and the state of performance thereof (iii) If the principal debtor has provided or intends to provide any other assets as security for the principal debt, information to that effect and the details thereof Provides information on the above *Only when the guarantor is an individual *If the guarantor fails to provide the information, the guarantor may rescind the guarantee contract. |

|

| At the time of claim from the guarantor | With respect to the principal, interest, penalties, etc., of the principal obligation (i) Existence or non-existence of default (ii) Amount remaining (iii) The amount of the remaining amount that is due and payable *Applicable whether the guarantor is an individual or a corporation. |

|

| When the principal debtor forfeits the benefit of time | Notification within two months of becoming aware of the forfeiture of the benefit of time limit. |

As mentioned above, there have been various changes in the provisions regarding guarantees due to the revision of the Civil Code. At our firm, we review and confirm various types of contracts in accordance with the revised Civil Code. Please feel free to contact us if you have any questions about whether it is acceptable to enter into a contract based on the content of the contract presented by your business partner, or if you have any concerns about the drafting of contracts, etc.