Antitrust Law Notification in M&A (Business Combination Regulations)

- 1 Outline of Antimonopoly Law Regulations in M&A

- 2 Regulation of Stock Acquisition in M&A

- 3 Advance Notification System in M&A

- 3.1 Share Acquisition Requiring Prior Notification

- 3.2 What is a Business Combination Group?

- 3.3 Explanatory Diagram of a Business Combination Group

- 3.4 What is “total domestic sales”?

- 3.5 Total domestic sales of the share issuing company and its subsidiaries

- 3.6 Definition of “Subsidiary” and “Parent Company

- 3.7 Documents Required for Notification upon Acquisition of Shares

- 3.8 Pre-notification consultation (optional)

- 4 Examination by the Fair Trade Commission

- 5 Problem Resolution Measures by the Filing Company

- 6 Cease and Desist Order by the Fair Trade Commission

- 7 Sanctions for Violation of the Antimonopoly Law

Outline of Antimonopoly Law Regulations in M&A

What is the Antimonopoly Law?

The Antimonopoly Law is an abbreviation for the “Law Concerning Prohibition of Private Monopolization and Maintenance of Fair Trade. The purpose of this law is to eliminate private monopolization, unfair restraint of trade, and unfair trade practices, to promote fair and free competition, and to allow business activities of businesses to flourish (Article 1, Antimonopoly Law).

Regulations of the Antimonopoly Law in M&A

Mergers and acquisitions, such as corporate takeovers and mergers, are intended to acquire another company or merge with another company. As a result, when M&A takes place, the size of the company is increased and its market share is also increased. For example, if a firm with a 50% market share merges with a firm with a 30% market share, the merged firm will acquire an 80% market share and will therefore acquire overwhelming price formation power. As a result, free competition among businesses would be inhibited and prices of goods and services would remain high, to the detriment of consumers. Therefore, the Antimonopoly Law requires that, in advance of any M&A above a certain size, a notification be submitted to the Fair Trade Commission, which is the administering agency of the Antimonopoly Law, for examination to determine whether any substantial restriction of competition will occur.

Points to be noted by those in charge of M&A

Persons in charge of M&A should always confirm whether the M&A in question is subject to the prior notification required by the Antimonopoly Law. If prior notification is required, the M&A transaction may not be conducted during the period of review by the Fair Trade Commission. Therefore, if advance notification is required, the person in charge of the M&A should prepare a schedule that takes into account the examination period stipulated in the Antimonopoly Act.

Regulation of Stock Acquisition in M&A

Chapter 4 of the Antimonopoly Law prohibits, in Articles 9 through 18, the holding of shares, concurrent appointment of directors, mergers, divisions, transfers of shares, and transfers of business that would substantially restrict competition in certain business fields.

Overview of Business Combination Regulations in M&A

Regulations differ for each M&A scheme, such as acquisition of shares by a company (Article 10), concurrent holding of directors and officers (Article 13), merger (Article 15), company split (Article 15-2), share transfer (Article 15-3), and business transfer (Article 16). Therefore, it is necessary to confirm the conditions and regulations for each scheme.

Article 10(1) of the Antimonopoly Law stipulates that “a company shall not acquire or hold shares in another company if such acquisition or holding would substantially restrict competition in a certain field of trade, and shall not acquire or hold shares in another company by unfair trade practices. ” The provisions of Article 10, Paragraph 1, of the Companies Act of Japan, as amended (hereinafter referred to as the “Act”), provide that In addition, in the event of an acquisition of shares that “would substantially restrict competition in a certain field of trade,” in violation of the provisions of Article 10, Paragraph 1, the Fair Trade Commission may order measures necessary to eliminate the violation of the law, such as the disposal of shares or partial transfer of business (Article 17 Article 17-2). Thus, although prior notification is required under Article 10, paragraph 2 and below regarding the acquisition of shares, the Fair Trade Commission prohibits the acquisition of shares “if it would substantially restrict competition in a certain field of trade,” regardless of whether or not notification has been made.

Concept of “Certain Fields of Trade

A “certain field of trade” is a market for goods or services. For example, it could be the market for corrugated paper or the market for wholesale food products. In practice, however, whether there is a substantial restriction of competition depends on how the market is viewed. For example, in the precision machinery manufacturing industry, if all precision machinery is considered as one market, the market share may be only 1%, but if the market is interpreted more narrowly and limited to the market for semiconductor inspection equipment, the market share may be over 30%. The Fair Trade Commission therefore decided to adopt the “market share” principle. Therefore, the JFTC has clarified that the market is “the scope for determining whether a business combination will result in a restriction of competition, and is to be judged from the viewpoint of substitutability from the viewpoint of consumers” as the basis. The Commission also clarified that substitutability from the consumer’s perspective is based on “the existence of a monopoly supplier of a certain product in a certain region, and the existence of a small but substantial and temporary price increase (5% to 10% as a general rule) for the purpose of profit maximization by such a monopoly supplier, and the fact that consumers are likely to shift their purchases of such product to other products or regions. The decision will be made by taking into consideration the extent to which consumers would shift their purchases of the product in question to other products or regions. If consumers are unable to take alternative measures such as purchasing other substitutable products or purchasing from other regions, competition in a certain trade area will be judged to have been restricted.

“Scope of goods” and “geographic scope

The Fair Trade Commission has also issued guidelines on the concept of “scope of goods” and “geographical scope,” clarifying that judgments shall be made according to the existence and degree of “substitutability of goods from the consumer’s viewpoint.

Advance Notification System in M&A

Regarding which cases require advance notification, standards have been established for each transaction, including share acquisition, merger, company split, joint share transfer, and business takeover (Articles 10, 15, 15-2, 15-3, and 16 of the Antimonopoly Law). In this section, we will examine share acquisitions in detail.

The provisions of Article 10 of the Antimonopoly Law apply to M&A by way of share transfer. Article 10(2) of the Antimonopoly Law requires prior notification when a company falling under (1) below intends to acquire shares of a company falling under (2) below, if the company falls under (3) below.

(1) The total domestic sales of the company whose shares are to be acquired and companies other than the company concerned that belong to the business combination group to which the company concerned belongs exceeds 20 billion yen.

(2) The total domestic sales of the company issuing the shares and its subsidiaries exceed ¥5 billion.

(3) In the case where the notified company intends to acquire the shares of the share issuing company, the number of voting rights pertaining to the shares of the share issuing company to be held by the notified company after the acquisition as a proportion of the total number of voting rights of all shareholders of the share issuing company and the number of voting rights pertaining to the shares of the share issuing company held by companies other than the notified company, etc. that belong to the business combination group to which the notified company belongs. The ratio of the number of voting rights (ratio of voting rights held), which is the total of the number of voting rights pertaining to the shares of the share-issuing company to be held by the notified company after the acquisition and the number of voting rights pertaining to the shares of the share-issuing company held by companies other than the notified company that belong to the business combination group to which the notified company belongs, exceeds 20% or 50%.

The text of the Antimonopoly Law is difficult to understand, but roughly speaking, if a company with group sales of 20 billion yen or more acquires shares in a company with sales of 5 billion yen or more, and the shareholding ratio after the acquisition will exceed 20% or 50%, the company is required to file a prior notification. The company is required to file an advance notification.

What is a Business Combination Group?

A “business combination group” as defined in Article 10(2) of the Antimonopoly Law means a company, a subsidiary of the company, the ultimate parent company of the company (which is a parent company and not a subsidiary of another company), and a subsidiary of the ultimate parent company (which is not a subsidiary of another company). (2) “Business Combination Group” as defined in Article 10(2) of the Antimonopoly Act means a group consisting of the Company, subsidiaries of the Company, the ultimate parent company of the Company (which is a parent company and not a subsidiary of another company), and subsidiaries of the ultimate parent company (which excludes the Company and its subsidiaries) (2) “Group” means a group consisting of the following However, if the company in question does not have a parent company, the company in question becomes the ultimate parent company, and the group consisting of the company in question and its subsidiaries is the business combination group.

Explanatory Diagram of a Business Combination Group

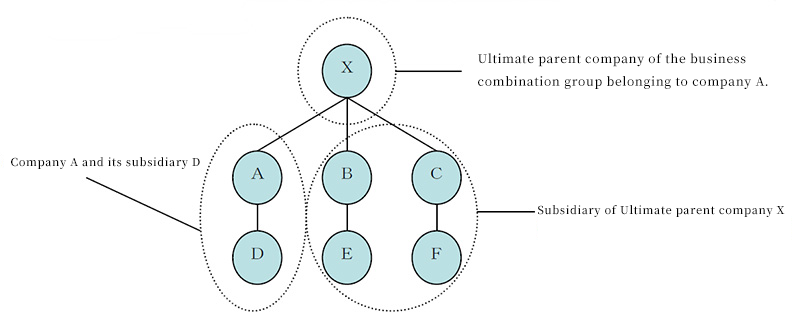

The following is an illustration of a “business combination group” as defined in Article 10.2 of the Antimonopoly Law. The meanings of each of the terms are as follows. In the diagram below, A, D, X, B, E, C, and F constitute a business combination group.

Company: A

Subsidiary of the company (A): D

Ultimate parent company of said company (A): X (but not a subsidiary of another company)

Subsidiary of such ultimate parent company (X): B, E, C, F

However, if A has no ultimate parent company, then the relevant company (A) is the ultimate parent company, and the group consisting of the relevant company (A) and its subsidiary (D) is the business combination group.

What is “total domestic sales”?

Total domestic sales” means the sum of the domestic sales of each of the companies, etc., belonging to the business combination group to which the company belongs. In the above figure, it means the total domestic sales of companies A, D, X, B, E, C, and F. Even if the notifying company (A) has no domestic sales, if the total sales of the entire business combination group exceeds 20 billion yen, it will meet this requirement.

The “total domestic sales of the share issuing company and its subsidiaries” is the sum of the domestic sales of the share issuing company and its subsidiaries, respectively. The share issuing company is the target company of the acquisition. Even if the stock-issuing company has no domestic sales, if its subsidiary’s sales exceed 5 billion yen, it may be required to submit a notification, satisfying the requirement in 2) above.

Definition of “Subsidiary” and “Parent Company

A “Subsidiary” means a joint stock company in which the Company holds a majority of the voting rights of all shareholders, or any other company in which the Company controls the financial and business policy decisions of another company, etc. A “parent company” is a company that controls the financial and business policy decisions of another company, etc., in cases where the company controls the financial and business policy decisions of that other company, etc.

The notification form under Article 10, Paragraph 2 of the Antimonopoly Act when acquiring another company through M&A is Form No. 4, “Notification of Plan Concerning Acquisition of Shares under Article 10, Paragraph 2 of the Act. In addition, when submitting an advance notification regarding the acquisition of shares, the following documents must be attached as attachments to the advance notification (see the Rules on Applications, Reports and Notifications, etc. for Approval under Articles 9 through 16 of the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade (hereinafter referred to as “Notification Rules”). ) (Article 2-6).

(1) a copy of the contract regarding the acquisition of shares or documents sufficient to prove the decision to acquire the shares

(2) Business report, balance sheet and profit and loss statement for the most recent one business year of the notified company

(3) When there is a resolution of a general meeting of shareholders or consent of all members regarding the acquisition of shares, a copy of the record of such resolution or consent

(4) securities reports prepared by the ultimate parent company of the business combination group to which the notified company belongs and other documents necessary and appropriate to show the status of assets and profits and losses of the business combination group to which the notified company belongs.

Pre-notification consultation (optional)

A party who intends to submit an advance notification regarding a share acquisition may voluntarily consult with the Fair Trade Commission prior to submitting the advance notification. In order to ensure smooth examination by the Fair Trade Commission, it is preferable for parties considering share acquisitions to conduct voluntary pre-notification consultation as much as possible.

Examination by the Fair Trade Commission

A company may not acquire shares until 30 days have elapsed from the date of acceptance of notification of share acquisition (Article 10, Paragraph 8 of the Antimonopoly Law). However, the Fair Trade Commission may shorten the 30-day prohibition period for share acquisition if it deems it necessary (proviso to Article 10, Paragraph 8 of the Antimonopoly Law). Upon receiving a request from a company concerned to shorten the period of prohibition of share acquisition, the JFTC will shorten the period of prohibition of share acquisition if the following two conditions are met

(1) When it is clear that there is no problem under the Antimonopoly Law in the case in question.

(2) When the notifying company makes a written offer to shorten the period of prohibition of share acquisition.

First Examination by the Fair Trade Commission

Within 30 days from the day following the date of receipt of the notification, the Fair Trade Commission will determine whether the business combination poses no problem under the Antimonopoly Law or whether it is a business combination requiring a detailed investigation. If, as a result of the initial examination, it is determined that there is no problem under the Antimonopoly Law, the JFTC will notify the notifying company that it will not issue a cease and desist order (Article 9 of the Notification Rules). This terminates the Antimonopoly Law procedures, and the company is then free to conduct the share acquisition.

Secondary Examination by the Fair Trade Commission

If the JFTC determines that a more detailed examination is necessary during the first stage examination, the case will proceed to the second stage examination. It is said that only about 1% of all cases proceed to the second stage of examination. In the case of proceeding to the Secondary Examination, the JFTC may request the applicant to submit reports, information or materials as stipulated in the JFTC Regulations within the prohibited period of 30 days. In this case, the JFTC must give notice that it will not issue a cease and desist order as there is no problem under the Antimonopoly Act by the later date of either 120 days from the date of receipt of the notification or 90 days from the date of receipt of all reports, etc., or hold an opinion hearing pursuant to Article 50(1) of the Antimonopoly Act (Article 10, Paragraph 9 of the Antimonopoly Law).

Problem Resolution Measures by the Filing Company

Even if, as a result of the second examination, it is determined that the share acquisition substantially restricts competition in a certain business field and violates the Business Combination Regulations, the notifying company may propose to the Fair Trade Commission that it “formulates and attempts to implement measures necessary to eliminate the conduct that has become the reason for suspicion The company may propose to the Fair Trade Commission that it “formulate and attempt to implement measures necessary to eliminate the suspected conduct. Such a plan is called a “cease and desist action plan” and is to be implemented upon approval by the Fair Trade Commission (Article 48-3 of the Antimonopoly Act). A cease and desist order will not be issued by the Fair Trade Commission because the plan is a measure to ensure that competition in a certain business field will not be substantially restricted and, if the plan is implemented, there will be no violation of the Business Combination Regulations. The contents of the cease and desist order may include, for example, transferring a business that restricts competition to a third party in order to reduce its market share.

Cease and Desist Order by the Fair Trade Commission

If, as a result of the examination, it is determined that the acquisition of the shares will substantially restrict competition in a certain business field, the Fair Trade Commission will order a cease and desist order against the party seeking to acquire the shares (Article 17-2, Paragraph 1 and Article 10, Paragraph 1 of the Antimonopoly Act). The cease and desist order will order the business operator to dispose of all or part of its shares, transfer part of its business, or take any other measures necessary to eliminate the violation of business combination regulations.

Sanctions for Violation of the Antimonopoly Law

Failure to Submit Prior Notification

In violation of the prior notification provisions set forth in Article 10.2 of the Antimonopoly Law, failure to submit an advance notification or making a false statement in the notification shall be punishable by a fine of up to 2,000,000 yen (Article 91-2, Paragraph 1, Item 3 of the Antimonopoly Law).

Similarly, an acquisition of shares during the 30-day prohibition period, even though the examination procedures have not been completed, is subject to a fine of not more than 2,000,000 yen (Article 91-2, Paragraph 1, Item 4 of the Antimonopoly Law).