Timely Disclosure in M&A

- 1 Timely Disclosure System

- 2 Corporate Information Requiring Timely Disclosure

- 3 Minority standards

- 4 Timing of disclosure

- 5 Disclosure Method

- 6 Sanctions for Violation of Timely Disclosure Rules

- 7 Fact of Listed Company’s Decision

- 7.1 Reorganization actions such as mergers

- 7.2 Transfer or Acquisition of All or Part of a Business

- 7.3 Transfer or Acquisition of Shares or Equity Interests Involving a Change in Subsidiary or Other Matters Involving a Change in Subsidiary or Other Matters

- 7.4 Changes in Major Shareholders or Largest Shareholder

- 7.5 Changes in Parent Companies, Controlling Shareholders, or Other Related Companies

Timely Disclosure System

Shares of listed companies are traded by general investors in the financial markets, and timely and appropriate disclosure of corporate information by listed companies to investors is fundamental to a sound financial instruments market (Article 401 of the Securities Listing Regulations of the Tokyo Stock Exchange) (Hereinafter referred to as the “TSE Listing Regulations”).

Therefore, in addition to the statutory disclosure under the Financial Instruments and Exchange Act, the TSE has established the “Rules on Timely Disclosure of Corporate Information by Issuer of Listed Securities” (hereinafter referred to as the “Timely Disclosure Rules”). The Rules require listed companies listed on the financial instruments markets they operate to disclose in a timely and appropriate manner any corporate information that is important to investors when making investment decisions. To provide an overview of the timely disclosure system, the Tokyo Stock Exchange has published the “Timely Disclosure Guidebook for Corporate Information” (hereinafter referred to as the “Timely Disclosure Guidebook”). The Timely Disclosure Guidebook is published by the TSE to provide an overview of the timely disclosure system. The Timely Disclosure Guidebook sets forth in detail the contents of timely disclosure, and the person in charge of the M&A should determine whether the M&A is subject to timely disclosure based on the Timely Disclosure Guidebook.

Corporate Information Requiring Timely Disclosure

Corporate information that is required to be disclosed in a timely manner is information regarding the business, operation, or performance of a listed company that has a material impact on investment decisions in securities. Specifically, it is classified as follows;

〇Information about the listed company

・Facts of decisions made by the listed company

・Facts of occurrence of the listed company

・Financial information of the listed company

・Other information (disclosure regarding reduction of investment units, disclosure regarding membership in the Financial Accounting Standards Foundation, disclosure regarding conversion or exercise of MSCBs, etc., disclosure of matters regarding controlling shareholders, etc., disclosure regarding delisting, etc.)

〇Information on subsidiaries, etc.

・Fact of decision of subsidiaries, etc.

・Fact of occurrence of a subsidiary, etc.

・Revision of earnings forecasts of subsidiaries, etc.

Minority standards

Even if corporate information is required to be disclosed in a timely manner, if the amount of the information is considered to be insignificant and does not affect investors’ investment decisions, the immateriality standard is applied and timely disclosure is not required. Whether or not the information falls under the immateriality standard is to be determined in accordance with the Listing Rules, Enforcement Rules, and Guidelines.

Timing of disclosure

Listed companies are required to disclose material corporate information immediately upon its determination or occurrence in accordance with the Listing Rules.

Disclosure Method

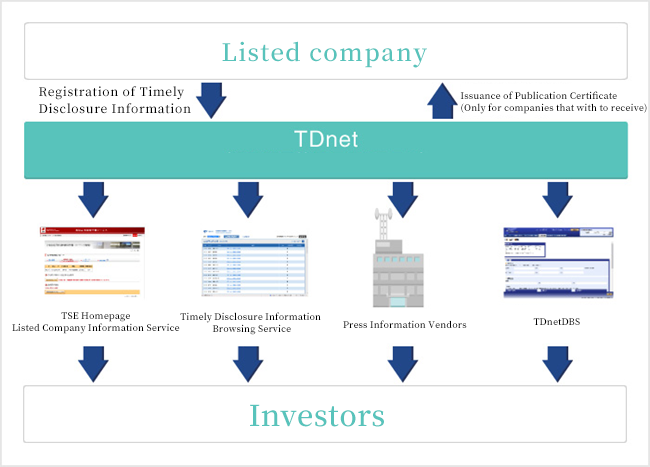

Companies listed on the Tokyo Stock Exchange are required to disclose information in accordance with the Listing Rules through the Timely Disclosure network (TDnet) operated by the Tokyo Stock Exchange, TDnet is a comprehensive system that enables prior explanation to the TSE, disclosure to the press, filing of disclosure materials, and public inspection. Please refer to the figure below for an explanation of how TDnet works.

(From the website of the Japan Securities Exchange Group)

Sanctions for Violation of Timely Disclosure Rules

If a listed company violates the duty of timely disclosure of corporate information and the TSE deems it necessary, the TSE may make a public announcement to the effect that the company has violated the duty of timely disclosure (TSE Listing Rule 508).

If a listed company violates the duty of timely disclosure of corporate information and the TSE deems that there is a high need for improvement in the internal control system of the listed company, the TSE may designate the listed shares issued by the listed company as securities on special caution (TSE Listing Rules, Rule 503). In addition, if the TSE deems that there is no prospect of improvement in the internal control system, etc., the listing may be delisted (TSE Listing Regulations, Article 601).

If a listed company violates its obligation to disclose corporate information in a timely manner and the TSE deems that there is a high need for improvement, the TSE may require the listed company to submit a report describing the circumstances and improvement measures (improvement report) and a report on the status of improvement (TSE Listing Rules Rule 504 and 505).

If the TSE deems that a listed company has violated its obligation to disclose corporate information in a timely manner and that the listed company has undermined the confidence of shareholders and investors in the TSE market, the TSE may require the listed company to pay a listing agreement penalty (TSE Listing Rules, Article 509).

Fact of Listed Company’s Decision

There are various types of information disclosure required when a listed company conducts M&A. Below are the contents of the Timely Disclosure Guidebook regarding information disclosure required in M&A.

Reorganization actions such as mergers

When the body that decides the business execution of a listed company decides to conduct a merger or other reorganization (share exchange, share transfer, merger, corporate split), it is required to disclose the details immediately (TSE Listing Rule 402.1.i, 402.1.j, 402.1.k, 402.1.1 ).

Transfer or Acquisition of All or Part of a Business

If the body that decides the business execution of a listed company decides to “transfer or acquire all or part of its business,” and if the details of the transfer or acquisition meet any of the following criteria, the company is required to immediately disclose the details (TSE Listing Rule 402, Item 1m).

a When all or part of the business is transferred

(a) The book value of the assets involved in the transfer of the business as of the end of the immediately preceding consolidated fiscal year is equal to or more than 30% of the consolidated net assets as of the same date.

(b) In either the consolidated fiscal year that includes the scheduled transfer date or the following fiscal year, the estimated decrease in consolidated net sales due to the transfer of the business is at least 10% of consolidated net sales for the immediately preceding consolidated fiscal year.

(c) In either the consolidated fiscal year that includes the scheduled date of the transfer of the business or the following fiscal year, the expected increase or decrease in consolidated ordinary income due to the transfer of the business is at least 30% of consolidated ordinary income for the immediately preceding consolidated fiscal year.

(d) In either the consolidated fiscal year that includes the scheduled date of the transfer of the business or the following consolidated fiscal year, the expected increase or decrease in net income attributable to shareholders of the parent company due to the transfer of the business is at least 30% of the net income attributable to shareholders of the parent company for the immediately preceding consolidated fiscal year.

(e) If none of the matters listed in Article 49, Item 8 (a) of the Ordinance on Regulation of Transactions is applicable.

b In the case of acquiring all or part of a business

(a) The expected increase in assets due to the acquisition of the business is equal to or more than 30% of consolidated net assets as of the end of the immediately preceding consolidated fiscal year.

(b) In either the consolidated fiscal year that includes the scheduled date of acquisition of the business or the following fiscal year, the expected increase in consolidated net sales due to the acquisition of the business is at least equal to 10% of consolidated net sales of the immediately preceding consolidated fiscal year.

(c) In either the consolidated fiscal year that includes the scheduled date of the business acquisition or the following fiscal year, the expected increase or decrease in consolidated ordinary income due to the business acquisition is at least 30% of consolidated ordinary income of the immediately preceding consolidated fiscal year.

(d) In either the consolidated fiscal year that includes the scheduled date of the business acquisition or the following fiscal year, the expected increase or decrease in net income attributable to shareholders of the parent company due to the business acquisition is at least 30% of net income attributable to shareholders of the parent company for the immediately preceding consolidated fiscal year.

(e) If none of the matters listed in Article 49, Item 8(b) or (c) of the Ordinance on Regulation of Transactions falls under any of the following items.

When the body that decides the business execution of a listed company decides to conduct “a transfer or acquisition of shares or equity involving a change in subsidiaries or other matters involving a change in subsidiaries or other parties” and the details meet any of the following criteria, the company is required to immediately disclose the details of the transfer or acquisition. (TSE Listing Rule 402, Item 1-q).

(a) The book value of the total assets of the subsidiary, etc. or the new subsidiary, etc. as of the end of the immediately preceding fiscal year is equal to or more than 30% of the consolidated net assets of the listed company as of the end of the immediately preceding consolidated fiscal year.

(b) The net sales of the subsidiary or newly-incorporated subsidiary for the immediately preceding fiscal year is equal to or more than 10% of the consolidated net sales of the listed company for the immediately preceding consolidated fiscal year.

(c) Ordinary income of the subsidiary or newly-incorporated subsidiary for the immediately preceding fiscal year is equal to or more than 30% of consolidated ordinary income of the listed company for the immediately preceding consolidated fiscal year.

(d) Net income for the immediately preceding fiscal year of the subsidiary or newly-incorporated subsidiary is equal to or more than 30% of the listed company’s net income attributable to shareholders of the parent company for the immediately preceding consolidated fiscal year.

(e) The number of purchases from the subsidiary, etc. or the new subsidiary, etc. in the immediately preceding fiscal year is equal to or more than 10% of the total amount of purchases of the listed company in the immediately preceding fiscal year.

(f) Sales to the subsidiary, etc. or the new subsidiary, etc. in the immediately preceding fiscal year are equal to or more than 10% of the total sales of the listed company in the immediately preceding fiscal year.

(g) The amount of capital or investment in the subsidiary or new subsidiary is equal to or more than 10% of the capital of the listed company.

(h) In the case of a subsidiary acquisition, the total amount of the consideration for the subsidiary acquisition plus the total amount of the consideration for other subsidiary acquisitions by the listed company that have been or will be carried out as part of the series of subsidiary acquisitions as determined by the body that determines the business execution of the listed company, is at least 15% of the consolidated net assets of the listed company as of the end of the immediately preceding consolidated fiscal year. (i) In the case of a Subsidiary Acquisition, the total amount of the consideration for the Acquisition is at least 15% of the listed company’s consolidated net assets as of the end of the immediately preceding fiscal year.

(i) In the case of a subsidiary acquisition, the total amount of the consideration for the subsidiary acquisition plus the total amount of the consideration for other acquisitions of subsidiaries by the listed company that have been or will be carried out as part of a series of acquisitions by the listed company, as determined by the body that decides the business execution of the listed company, is at least equal to 15% of the listed company’s net assets as of the last day of the immediately preceding fiscal year The total amount of the listed company’s consideration for the acquisition of other subsidiaries by the listed company, as determined by the body that determines the business execution of the listed company, is at least 15% of the listed company’s net assets as of the end of the immediately preceding fiscal year.

(j) If the listed company does not fall under Article 49, Item 11 of the Regulation for Financial Instruments and Exchange Law.

Listed companies are required to disclose the details of any “change in a major shareholder or the largest shareholder as a major shareholder” immediately. A change in a major shareholder or the largest shareholder as a major shareholder refers to the following cases (TSE Listing Rule 402, Item 2b).

〇A person who has been a major shareholder ceases to be a major shareholder.

〇A person who has not been a major shareholder becomes a major shareholder.

〇Cases in which a person who was the largest shareholder as a major shareholder ceases to be the largest shareholder

〇When a person who was not the largest shareholder becomes the largest shareholder as a major shareholder

A major shareholder is a shareholder as defined in Article 163, Paragraph 1 of the Financial Instruments and Exchange Law, who holds 10% or more of the voting rights of all shareholders under his or her own name or in the name of another person.

Listed companies are required to disclose the details of any change in parent company, controlling shareholder, or other related company immediately (TSE Listing Rule 402, Item 2g).

〇Change in parent company

・A person who was not a parent company becomes a new parent company.

・When a “parent company” ceases to be a “parent company

〇Change in controlling shareholder

・A person who was not a “controlling shareholder” becomes a new “controlling shareholder.

・When a “controlling shareholder” ceases to be a “controlling shareholder

〇Change in other affiliated companies

・When a person who was not an “other affiliated company” becomes a new “other affiliated company

・When an “other affiliated company” ceases to be an “other affiliated company